Don’t Get Left in the Cold: Easy Ways to Finance Your New Water Heater

By Brian on September 10, 2025

Why Water Heater Financing Makes Sense for Northern California Homeowners

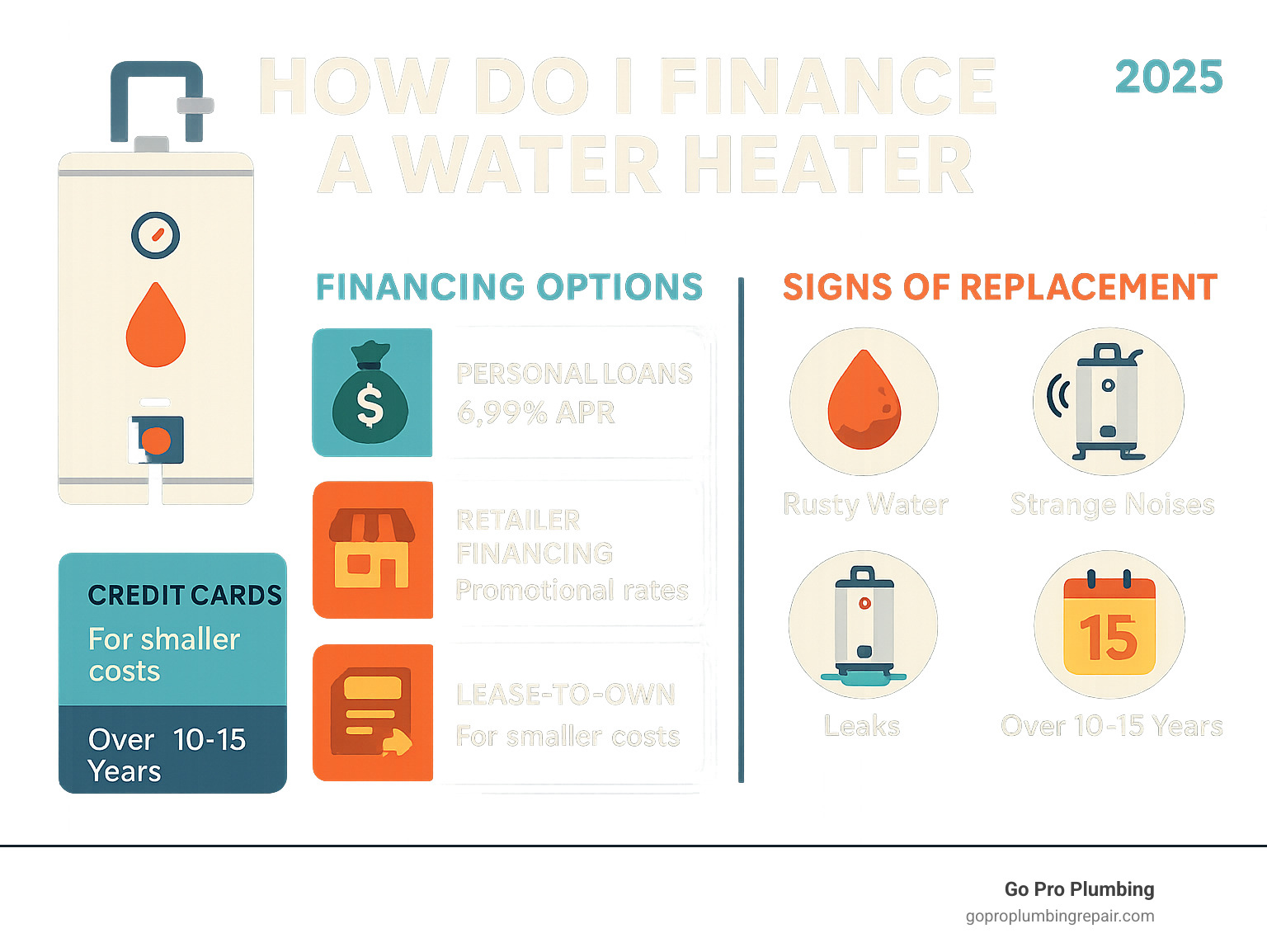

If you’re wondering how do I finance a water heater, you have several practical options available:

- Personal loans from banks or credit unions with fixed rates starting around 6.99% APR

- Retailer financing through plumbing companies offering promotional 0% APR periods

- Credit cards with introductory 0% APR offers for smaller repairs

- Lease-to-own programs that focus on income rather than credit history

Nothing jolts you awake quite like stepping into a cold shower when you’re expecting hot water. When your water heater fails unexpectedly, it creates an urgent need that can’t wait – but the cost of replacement doesn’t have to drain your savings account.

The average water heater replacement costs between $811 and $2,500, including installation. For many Northern California homeowners, this represents a significant unexpected expense. The good news? Financing options make it possible to get your hot water flowing again without the financial stress.

Whether you’re dealing with a 15-year-old tank that’s reached the end of its lifespan or facing emergency repairs on a failing unit, understanding your financing options helps you make the best decision for your budget and timeline.

Is It Time for a Replacement? Key Warning Signs

Before you start wondering how do I finance a water heater, you’ll want to make sure you actually need a new one. Trust us – we’ve seen plenty of homeowners panic over a minor issue that could be fixed with a simple repair. But we’ve also seen the aftermath when warning signs get ignored, and that’s never pretty.

Age is usually the biggest tell. If your traditional tank water heater is pushing 8 to 12 years old, it’s living on borrowed time. You can check the manufacturing date on that serial number sticker – though fair warning, it’s often written in code that looks like it was designed by secret agents. Tankless units are the marathon runners of the water heater world, often lasting up to 20 years with proper care.

When your hot water starts looking like weak coffee, that’s rusty or discolored water telling you there’s corrosion happening inside the tank. This rust doesn’t magically disappear – it only gets worse until your tank decides to spring a leak at the most inconvenient moment possible.

Strange noises are your water heater’s way of crying for help. If you’re hearing rumbling, banging, or sounds that make you wonder if there’s a washing machine tumbling down the stairs, that’s sediment buildup hardening at the bottom of your tank. Think of it like a really stubborn layer of concrete that makes your water heater work overtime just to heat your water.

Here’s the sign that should send you straight to the phone: leaks or moisture around the base. Even a small puddle means your tank has developed cracks from corrosion. Unlike a leaky faucet, this isn’t something you can fix with a new washer. When tanks crack, they’re done.

Inconsistent water temperature is frustrating in a whole different way. One minute you’re enjoying a nice hot shower, the next you’re doing the cold-water dance while soap is still in your hair. When your water heater can’t maintain consistent temperatures or runs out of hot water much faster than usual, it’s struggling to do its job.

If any of these sound familiar, it’s time to call in the professionals. We’ll give you an honest assessment of whether your water heater needs a repair or if it’s time to start exploring your options for replacement and financing.

Budgeting for Your New Water Heater: A Cost Breakdown

Let’s talk numbers – because understanding the real costs is essential when you’re wondering how do I finance a water heater. The good news? You have more control over your budget than you might think.

Most homeowners spend between $811 and $2,500 for a complete water heater replacement, including installation. The average sits around $1,327, though premium systems can reach $3,900. That might sound like a lot, but remember – you’re investing in daily comfort and convenience for the next decade or more.

Here’s where it gets interesting: the unit cost and installation labor make up two distinct parts of your total investment. Understanding this breakdown helps you make smarter financing decisions and avoid surprises.

Traditional tank water heaters offer the most budget-friendly entry point, typically costing $700 to $2,000 for the complete project. A quality 50-gallon tank – perfect for most families – ranges from $530 to $900 for the unit alone, with installation adding another $200 to $800 depending on complexity. These reliable workhorses have been keeping families comfortable for decades.

Tankless water heaters represent a bigger upfront investment at $1,400 to $3,900 total, but here’s the exciting part: they can slash your monthly utility bills by up to 30%. Plus, they last up to 20 years compared to the 8-12 year lifespan of tank models. When you factor in long-term savings, the math often works in your favor.

Several key factors influence your final price tag. Size matters – while a 40-gallon unit works for smaller families, you might need a 50 or 75-gallon tank for larger households. Fuel type plays a significant role too. Gas units often cost more to install if you need new gas lines, but they’re typically more efficient for heavy usage. Electric models usually have simpler installations but potentially higher operating costs.

Installation labor varies from $45 to $200 per hour, with electricians charging $50 to $100 per hour when electrical work is needed. Complex jobs – like converting from tank to tankless – naturally cost more due to additional plumbing, venting, or electrical modifications. Trust us, professional installation isn’t just about safety and local code compliance; it also protects your manufacturer’s warranty.

Don’t overlook energy efficiency when budgeting. Higher-efficiency models cost more initially but deliver ongoing savings on your utility bills. Plus, you might qualify for tax credits or rebates that significantly reduce your out-of-pocket costs.

At Go Pro Plumbing, we believe in transparent pricing with no hidden surprises. We’ll walk you through every cost factor and help you find the perfect balance between upfront investment and long-term value.

How Do I Finance a Water Heater? Comparing Your Top 4 Options

When you’re staring at a failed water heater and wondering how do I finance a water heater, the good news is you have several solid options. Each approach has its sweet spot, depending on your credit situation, budget, and timeline.

Let me walk you through the four most practical financing paths, so you can choose what works best for your situation.

| Financing Option | Typical APR | Best For | Key Consideration |

|---|---|---|---|

| Personal & Home Impr. Loans | 6.99% – 36% (or more) | Larger expenses, good credit, predictable payments | Fixed terms, can cover installation, but requires good credit |

| Go Pro Plumbing Financing | Varies (often 0% promo) | Convenience, quick approval, specific to home services | Promotional periods, but be aware of deferred interest |

| Credit Cards | 0% intro, then 15-30%+ | Smaller repairs, quick access, rewards | High interest if not paid quickly, can impact credit utilization |

| Lease-to-Own Programs | N/A (monthly payments) | Challenged credit, no large upfront cost | Not true ownership initially, may have higher total cost over time |

Personal and Home Improvement Loans

Personal loans are often the go-to choice for water heater financing, especially when you need to cover both the unit and installation costs. Think of them as the reliable friend in your financing toolkit – straightforward, predictable, and available from multiple sources.

Banks offer traditional personal loans, though you’ll need decent credit to snag their best rates. Credit unions often beat bank rates and tend to be more understanding if your credit isn’t perfect. Online lenders have really changed the game, with platforms connecting you to multiple lenders and APRs starting as low as 6.99% for qualified borrowers.

The beauty of these loans lies in their fixed interest rates and predictable monthly payments. You’ll know exactly what you owe each month, making it easy to budget around your new water heater. Most lenders can approve you quickly, so you won’t be stuck with cold showers for long.

The application process is usually painless – many online lenders let you check rates without dinging your credit score. Just remember to shop around and compare offers before committing.

Go Pro Plumbing Financing

Here’s where things get convenient. As your Northern California plumbing team, we’ve seen how stressful unexpected water heater failures can be. That’s exactly why we offer financing directly through Go Pro Plumbing.

The biggest advantage? Convenience. You can apply for financing right during your service appointment – no separate trips to the bank or waiting for loan approvals while you’re stuck without hot water. We handle everything in one place.

We regularly run promotional periods with attractive terms, including 0% APR offers for qualified customers. These promotions might give you 6, 12, or even 18 months to pay off your water heater without any interest charges. It’s like getting an interest-free loan, as long as you pay the balance within the promotional window.

Since our financing is designed specifically for home improvement needs, the terms make sense for water heater projects. We understand the typical costs and can structure payments that work with your budget.

Just remember – with any promotional financing, you’ll want to understand what happens if you don’t pay off the full balance before the promotional period ends. We’re always happy to walk you through all the details so there are no surprises.

Credit Cards

Credit cards can be your fastest financing option, especially for smaller water heater repairs or if you’re replacing a basic unit. They’re already in your wallet, after all.

For smaller costs, credit cards offer immediate access to funds. No application process, no waiting for approval – just swipe and get your hot water back. If you have a rewards credit card, you might even earn some cash back or points on your purchase.

The real winner here is a 0% introductory APR credit card. Many cards offer 6 to 18 months without interest on new purchases. If you can pay off your water heater within that timeframe, it’s essentially free financing.

But here’s the catch – credit cards can bite back hard if you don’t pay them off quickly. Standard APRs often run 15% to 30% or higher, which can make your water heater much more expensive than planned. Plus, a large purchase can bump up your credit utilization ratio, potentially affecting your credit score temporarily.

Lease-to-Own Programs

Lease-to-own programs are the unsung heroes of water heater financing, especially if traditional loans aren’t an option for you. These programs work on a rent-to-own model where you make monthly payments to use the water heater, with the option to own it outright once all payments are complete.

What makes these programs special is their accessibility for lower credit scores. Instead of obsessing over your credit history, they focus on your ability to make monthly payments. Some programs start as low as $19 per month, making them incredibly accessible when you’re facing an emergency replacement.

You also won’t need a large upfront payment, which can be a lifesaver when your water heater fails unexpectedly. Your credit cards stay available for other emergencies, and you can spread the cost over manageable monthly payments.

The tradeoff? Lease-to-own programs may result in a higher total cost over the life of the agreement compared to buying outright or using a traditional loan. You’re paying for the convenience and accessibility, so make sure you understand the total cost of ownership before signing up.

Each of these financing options has helped countless Northern California homeowners get their hot water flowing again without breaking the bank. The key is choosing the one that fits your credit situation, budget, and comfort level.

Navigating Financing with Challenged Credit

We get it – life throws curveballs, and sometimes your credit score takes a hit along the way. Maybe you went through a tough financial period, faced unexpected medical bills, or dealt with job loss. Whatever the reason, having less-than-perfect credit doesn’t mean you should have to live without hot water when your water heater fails.

Let’s be honest about the challenges first. Having challenged credit typically means facing higher interest rates and fewer financing options. While borrowers with excellent credit might qualify for APRs starting around 6.99%, those with poor credit scores often see rates that are significantly higher – sometimes 20% or more. It’s not fair, but it’s the reality of how most traditional lenders assess risk.

The good news? Several financing paths remain open to you, and some are specifically designed for people in your situation.

Lease-purchase funding programs often provide the most accessible route when you’re wondering how do I finance a water heater with poor credit. These programs work differently than traditional loans. Instead of focusing primarily on your credit history, they evaluate your current income and employment stability. Companies offering these services understand that your past financial struggles don’t necessarily reflect your current ability to make monthly payments.

With lease-to-own options, you can typically get approved with minimal upfront costs and start using your new water heater right away. The monthly payments are often quite reasonable – some programs start as low as $19 per month. While you’ll likely pay more over time compared to a cash purchase, you get immediate access to hot water without the stress of a large unexpected expense.

Finding a cosigner can dramatically improve your financing options if you have a trusted family member or friend with good credit. When someone cosigns your loan, they’re essentially vouching for you and agreeing to take responsibility if you can’t make payments. This reduces the lender’s risk and often results in much better interest rates and terms. Just remember that this is a big responsibility for your cosigner, so make sure you’re confident about making your payments on time.

Some lenders and financing programs focus more on your income and employment history than your credit score. If you have steady work and can demonstrate reliable income, these lenders view you as less risky than your credit score might suggest. This approach recognizes that people can rebuild their financial lives and deserve a second chance.

Reading all terms and conditions carefully becomes even more critical when you have challenged credit. Some lenders unfortunately target people with poor credit with predatory terms, hidden fees, or balloon payments that can create bigger problems down the road. Take time to understand exactly what you’re agreeing to, including the total cost over the life of the agreement, any penalties for late payments, and what happens if you want to pay off the balance early.

Your current credit situation isn’t permanent. Successfully managing a water heater financing agreement and making consistent on-time payments can actually help rebuild your credit score over time. Every payment is a step toward better financial health and more options in the future.

At Go Pro Plumbing, we’ve worked with countless homeowners facing similar challenges, and we’re committed to helping you find a financing solution that works for your situation. Don’t let credit concerns keep you in cold showers – there are paths forward that can get your hot water flowing again.

Frequently Asked Questions about Water Heater Financing

We often get questions from our Northern California customers about the ins and outs of financing a water heater. Here are some of the most common ones we hear, along with honest answers that’ll help you make the best decision for your situation.

How do I finance a water heater if I have bad credit?

Let’s be real – having challenged credit doesn’t mean you’re stuck with cold showers. How do I finance a water heater with less-than-perfect credit is one of our most frequent questions, and the good news is you have several solid options.

Lease-to-own programs are often your best bet. Companies like Microf focus on your current income and ability to make payments rather than dwelling on past credit hiccups. You’re essentially renting the unit with the option to own it, which takes a lot of pressure off the approval process.

If you have something valuable to use as collateral, secured loans can open doors that regular loans keep shut. Your car or savings account can back the loan, which makes lenders much more comfortable offering you better rates.

Getting a cosigner can be a game-changer if you have a trusted family member or friend with good credit. They’re essentially vouching for you, which can dramatically improve your approval odds and snag you much better terms.

Specialized lenders also cater to folks with lower credit scores. While you’ll likely pay higher interest rates and fees, these lenders understand that everyone deserves access to essential home repairs. Platforms like Acorn Finance let you compare offers without initially dinging your credit score.

Our advice? Start by exploring lease-to-own programs or give us a call directly. We’re committed to helping all our customers find a solution that works.

How do I finance a water heater and its installation together?

Most financing options are designed to cover your entire project from start to finish – both the shiny new water heater and the professional installation that ensures it works perfectly.

Personal loans and home improvement loans give you a lump sum that covers everything. You get one payment, we handle the complete job, and you’re back to enjoying hot showers without juggling multiple bills.

When you choose Go Pro Plumbing financing options, our plans are specifically designed to cover the total project cost. That means the equipment and our expert labor are all wrapped into one convenient package. No surprises, no separate bills – just one seamless process from selection to installation.

Retailer financing through major home improvement stores can also work if you’re purchasing the unit and arranging installation separately, though this often creates more complexity.

The key is making sure your loan amount covers the entire estimated cost, including any permits or additional parts we might find during installation. We always provide transparent estimates upfront so you know exactly what to expect.

Are there tax credits or rebates for a new water heater?

Here’s some great news that can make your wallet happy – upgrading to an energy-efficient water heater doesn’t just save money on monthly bills, it can also put cash back in your pocket through various incentive programs.

Federal tax credits for high-efficiency models are available for certain qualifying water heaters like heat pump units or highly efficient tankless systems. These aren’t deductions – they’re direct credits that reduce what you owe the IRS dollar for dollar.

Your local utility company likely offers rebates for energy-efficient upgrades too. Many Northern California gas and electric providers have programs that can significantly offset your upfront costs. It’s worth a quick call to ask about current rebate programs.

State-level incentives add another layer of potential savings. While programs vary by location, many states offer their own rebate or tax incentive programs for energy-efficient home improvements. California has been particularly generous with these types of programs.

We stay current on qualifying models and can help you steer the process of claiming these benefits. It’s like getting paid to upgrade your home – and who doesn’t love that? Just remember that incentive programs can change, so it’s worth checking what’s available when you’re ready to make your purchase.

Conclusion: Get Your Hot Water Flowing Again

Nobody wants to start their morning with an ice-cold shower, especially when you’re already running late for work. But here’s the good news – dealing with a broken water heater doesn’t have to drain your bank account or leave you stressed about how do I finance a water heater.

Throughout this guide, we’ve walked through the practical solutions that make water heater replacement manageable for every Northern California homeowner. Whether you’re dealing with an emergency replacement at 6 AM or planning an efficiency upgrade to save on those monthly utility bills, financing options are more accessible than most people realize.

The key is finding the right fit for your situation. Personal loans offer predictable monthly payments if you have decent credit. Go Pro Plumbing financing provides the convenience of handling everything in one place, often with promotional periods that can save you money. Credit cards work great for smaller repairs when you can pay them off quickly. And lease-to-own programs focus on your income rather than your credit history, making hot water accessible even when life has thrown you some financial curveballs.

Every budget and credit profile has options available. The most important step is honestly assessing your financial situation, comparing the terms that matter most to you, and choosing the path that lets you sleep soundly at night – knowing your hot water will be there in the morning.

At Go Pro Plumbing, we understand that plumbing emergencies don’t wait for convenient times. That’s why we’re committed to outstanding customer service and same-day service for our neighbors throughout Rancho Cordova, Sacramento, and the greater Northern California area. We’re not just here to install your new water heater – we’re here to help you steer the entire process, from choosing the right unit to finding financing that works.

Your family deserves reliable hot water, and you deserve peace of mind about how to pay for it. Explore your water heater financing options with us today!