Simple Steps to Finance Your Water Heater

By Brian on September 30, 2025

Why Easy Water Heater Financing Makes Sense for Your Home

When your water heater breaks unexpectedly, finding easy finance water heater options can turn a stressful emergency into a manageable situation. Here are the quickest ways to finance your water heater replacement:

Top Easy Financing Options:

- Contractor financing programs – Apply directly through your plumber with instant approval

- Personal loans – Fixed rates starting around 6.40% APR for qualified borrowers

- Government rebates – Up to $700 in incentives for energy-efficient models

- Utility financing – Pay over time through your monthly utility bill

As research shows, an unexpected water heater replacement can be a financial burden on homeowners. The good news? You don’t need to drain your savings or go without hot water.

Modern financing options let you spread the cost over manageable monthly payments while getting your hot water restored immediately. With programs offering $0 down and flexible terms up to 20 years, you can even upgrade to a high-efficiency model that saves money long-term.

Many homeowners find they can finance a new water heater for as little as $39 per month, making it easier than ever to maintain home comfort without breaking the budget.

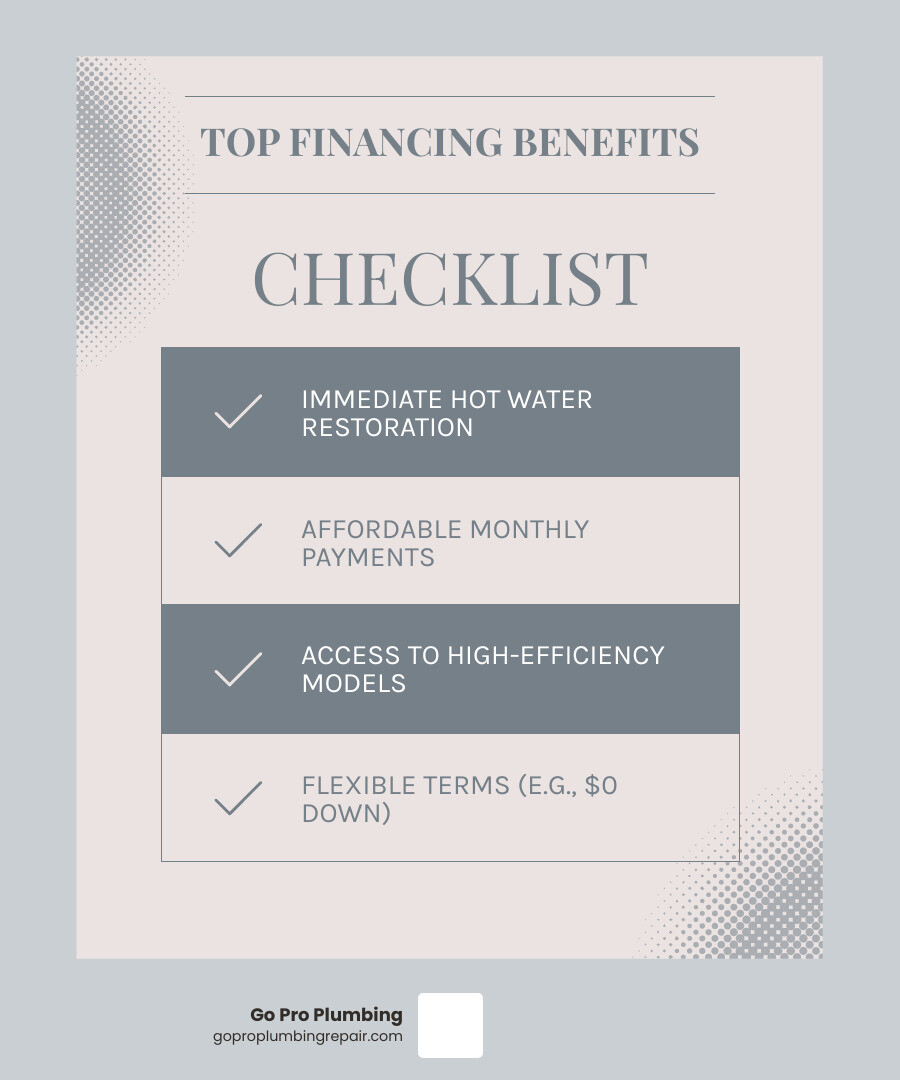

The Core Benefits of Financing Your Water Heater

Imagine a cold morning, you step into the shower, and… nothing. Just cold water. A broken water heater isn’t just an inconvenience; it’s a household emergency. This is where financing truly shines. We understand that having a steady supply of hot water is essential for everything from morning showers to washing dishes and laundry. When your existing unit gives up the ghost, replacing it isn’t optional – it’s a necessity.

Financing offers immediate comfort by allowing you to get a new water heater installed right away, without waiting to save up a large sum. This means no more cold showers or emergency trips to the gym just to get clean! It also helps with budget management, preventing the need to drain your hard-earned savings or resort to high-interest credit cards for an unexpected major expense. By choosing an easy finance water heater solution, you gain access to superior, often more energy-efficient models that might otherwise be out of reach, leading to significant long-term savings on your utility bills.

Manage Unexpected Costs with Affordable Monthly Payments

The abrupt failure of a water heater can hit your finances like a surprise party you didn’t RSVP for. Instead of a hefty upfront payment that can disrupt your budget, financing allows you to spread the cost over a period that suits you, often with terms extending up to 20 years. This means predictable, manageable monthly payments that fit comfortably into your household budget.

For instance, some financing options can get you a new system for as little as $39 per month. This financial flexibility provides immense peace of mind, knowing that your home’s essential hot water supply is secured without causing undue financial strain. Think of it as turning a large, intimidating bill into a series of smaller, friendly ones. You get the hot water you need, when you need it, without the immediate financial burden.

Upgrade to a High-Efficiency Model for Long-Term Savings

Did you know that water heaters are one of the biggest energy consumers in your home? According to research, water heaters use about 12% of a home’s energy, and water heating accounts for 20% of the average home’s energy use. That’s more energy than your refrigerator, clothes washer, dishwasher, and dryer combined!

This is where financing an upgrade to a high-efficiency model truly pays off. While these units might have a higher upfront cost, the energy savings they provide can quickly offset that difference. For example, an ENERGY STAR certified electric water heater can save a household of four approximately $600 per year on its electric bills compared to a standard electric water heater. Over its lifetime, that can add up to more than $4,500 in savings!

Switching to an ENERGY STAR certified heat pump water heater, for instance, can save you hundreds of dollars every year on energy costs because they use about one-quarter of the energy of a standard model. This isn’t just good for your wallet; it’s also great for the environment, reducing your carbon footprint. Many of our customers find that the payback period for the higher upfront cost of a heat pump water heater can be as short as three years, thanks to these substantial energy savings. It’s an investment that keeps on giving, making your home more comfortable, efficient, and environmentally friendly. To learn more about how different water heater types stack up in terms of efficiency, explore our guide on Are Tankless Water Heaters More Efficient?.

Your Guide to Easy Finance Water Heater Options

When it comes to getting a new water heater, you typically have a few choices: buying outright, renting, or financing. Each has its pros and cons, and understanding them can help you decide which easy finance water heater option is best for your situation.

| Factor | Buying Outright | Financing | Renting |

|---|---|---|---|

| Upfront Cost | High (full purchase price + installation) | Low to $0 (depending on financing terms) | Low (initial installation fee or small setup cost) |

| Monthly Payment | None (after initial purchase) | Predictable monthly payments | Fixed monthly rental fee |

| Ownership | You own the unit from day one | You own the unit from day one | You do not own the unit (rental company owns it) |

| Maintenance & Repairs | Your responsibility (unless under warranty) | Your responsibility (unless under warranty) | Typically covered by rental company |

| Long-Term Value | Asset, potential resale value | Asset, builds equity in your home | No long-term asset or equity |

| Flexibility | Complete control over upgrades/replacements | Flexible terms, potential for early payoff | Limited flexibility, tied to rental agreement |

As you can see, financing offers a compelling middle ground, giving you the immediate ownership benefits without the large upfront cost. We work with various financing partners to offer solutions that fit diverse needs.

Leveraging Government Incentives and Rebates

One of the most exciting aspects of getting a new, energy-efficient water heater is the potential for significant savings through government incentives and utility rebates. These programs are designed to encourage homeowners to switch to more sustainable and cost-effective energy solutions.

For example, the federal government offers tax credits for certain energy-efficient home improvements. Through December 31, 2025, you can qualify for a federal tax credit of 30% up to $2,000 for ENERGY STAR certified heat pump water heaters. This can substantially reduce your out-of-pocket expenses. You can learn more about how to Save with Tax Credits for Energy Efficiency (Video).

Beyond federal incentives, many states and local utility companies also offer their own rebate programs. These can range from direct cash rebates for installing qualifying models to low-interest loans or even on-bill financing, where the cost of the upgrade is added to your monthly utility bill, often offset by the energy savings. We encourage our customers to check with their local utility providers and state energy offices for available programs. For instance, some programs offer up to $700 in incentives!

For low-to-moderate income families, additional assistance programs are available. The Department of Energy offers a Weatherization Assistance Program (WAP) which helps qualifying households with home energy assessments and weatherization improvements. Similarly, the Low Income Energy Assistance Program (LIHEAP) offers help with home repairs and upgrades based on household size and income. It’s worth exploring these options if you qualify, as they can significantly reduce the cost of your water heater upgrade. For more tips on reducing your energy consumption, check out our insights on Water Heater Energy Savings.

Key Differences: Financing a Tank vs. a Tankless Water Heater

When considering financing for a new water heater, a crucial decision often arises: should you go with a traditional tank water heater or upgrade to a tankless model? The choice impacts not only your hot water experience but also the financing amount and long-term value.

Upfront Cost and Loan Amount Differences:

Generally, tankless water heaters have a higher upfront cost than traditional tank models. This means the loan amount for financing a tankless unit will typically be higher. However, don’t let the initial price tag deter you. While a standard 50-gallon tank water heater might cost less to purchase and install, a tankless unit, which heats water on demand, often requires more complex installation, including potential gas line upgrades or dedicated electrical circuits, which adds to the initial cost. Because of this, when you finance, you might see slightly higher monthly payments for a tankless system.

Long-Term Value and Energy Savings Offset:

This is where tankless water heaters truly shine and justify their financing. As we discussed, water heating is a major energy expense. Tankless models are significantly more energy-efficient because they only heat water when you need it, eliminating standby heat loss associated with traditional tanks. This efficiency can lead to substantial energy savings over the life of the unit, which helps to offset the higher initial financing cost.

For example, while you might finance a few extra dollars per month for a tankless unit, the energy savings could easily be double or triple that amount, effectively making the tankless option more affordable in the long run. The long-term value of a tankless water heater also includes its longer lifespan (often 20+ years compared to 10-15 for tank models) and the endless supply of hot water, which improves your home’s comfort and appeal. When considering an easy finance water heater solution, we always recommend looking at the total cost of ownership, not just the purchase price. For more detailed information on financing these modern systems, visit our page on Tankless Water Heater Financing.

How to Get Approved: Understanding the Fine Print

So, you’ve decided that financing is the right path for your new water heater. Great choice! The next step is navigating the application process. We understand that applying for financing can sometimes feel a bit daunting, but we work to make it as simple and transparent as possible. Our goal is to ensure a fast credit decision so you can get your new water heater installed without unnecessary delays.

The application process typically involves a quick credit check to determine your eligibility and the best financing terms available to you. Many of our financing partners offer instant or same-day approvals, meaning you could have your new water heater up and running in no time.

What to Expect: Typical Terms and Conditions

When you apply for water heater financing, understand the typical terms and conditions. These details will outline your repayment responsibilities and the overall cost of your loan.

- Annual Percentage Rate (APR) and Interest Rates: This is the cost of borrowing money, expressed as a yearly rate. Our financing partners strive to offer competitive interest rates, often with lower APRs than most general bank cards. For example, personal loans for home improvements can offer fixed rates starting around 6.40% for qualified borrowers. It’s important to compare these rates to ensure you’re getting a good deal.

- Loan Term Length: This refers to the duration over which you’ll repay the loan. Flexible terms are often available, ranging from a few months to several years, sometimes up to 12 years or even 20 years with certain programs. A longer term means lower monthly payments but potentially more interest paid over time.

- $0 Down Payment Options: Many financing programs offer the convenience of $0 down payment, meaning you don’t have to pay anything upfront to get your new water heater installed. This is a huge benefit, especially in emergency replacement situations.

- Prepayment Penalties: We believe in transparency and flexibility. Many of our financing options come with an “open loan” feature, meaning you can pay off a lump sum or the entire balance at any time without incurring any prepayment penalties. This allows you to pay off your loan faster if your financial situation improves, saving you money on interest.

- Administration Fees: Some financing programs may include a small administration fee to process the loan. For instance, one program mentioned a $39.95 admin fee. We will always make you aware of any such fees upfront so there are no surprises.

Understanding these terms ensures you’re making an informed decision about your easy finance water heater solution. For more details on our financing options, visit our Finance Hot Water Heater page.

The Application Process: What You’ll Need

Applying for water heater financing is designed to be a simple process, often completed quickly with your contractor’s assistance. While specific requirements can vary slightly between financing providers, here’s a general list of information you’ll typically need to provide:

- Government-issued ID: This could be a driver’s license, state ID, or passport to verify your identity.

- Proof of income: Lenders need to ensure you have the capacity to repay the loan. This might include recent pay stubs, tax returns, or bank statements.

- Social Security Number (SSN): Your SSN is typically required for the credit check.

- Basic personal information: This includes your full name, current address, phone number, and email address.

- Bank account details: For setting up convenient pre-authorized monthly payments.

The process is designed to be personal and confidential, ensuring your data is handled securely. We aim for fast credit decisions, so you can often get approval within minutes, allowing us to proceed with your water heater installation promptly.

Finding a Reputable Installer Who Offers Financing

Choosing the right plumbing contractor is just as important as choosing the right financing plan. A reputable installer will not only ensure your water heater is installed correctly and safely but will also guide you through the financing options available to you. Vetting contractors and asking the right questions upfront can save you a lot of headaches (and cold showers!) down the line.

What to Look for in a Plumbing Contractor

When you’re searching for a contractor to install your new water heater, especially if you’re looking for an easy finance water heater solution, here are key qualities we recommend you prioritize:

- Licensed and Insured: This is non-negotiable. A licensed contractor ensures they meet professional standards, and insurance protects you from liability in case of accidents or damage during the installation. We are fully licensed and insured, giving you peace of mind.

- Positive Customer Reviews: Check online reviews and testimonials. What do other homeowners say about their experience? Look for consistent praise regarding professionalism, quality of work, and customer service. For instance, our research indicates that companies with a long history and high customer satisfaction ratings, like those with “EXCELLENT” ratings from verified reviews, are a strong indicator of reliability.

- Transparent Pricing: A trustworthy contractor will provide a clear, detailed quote with no hidden fees. They should be able to explain all costs associated with the water heater unit, installation, and any additional services.

- Local Experience: A contractor with a strong local presence understands regional regulations, common plumbing issues in the area, and can provide quicker service. As a Northern California based company, we have extensive local experience.

- Offers Financing Options: Of course, if you’re looking for financing, ensure the contractor partners with reputable financing companies. They should be able to present you with various plans and help you steer the application process.

We pride ourselves on being your trusted Water Heater Pros, committed to outstanding customer service and ensuring your comfort.

Questions to Ask About Their Financing Plans

Once you’ve identified a reputable contractor, it’s time to dive into the specifics of their financing plans. Don’t be shy about asking questions; a good contractor will be happy to provide all the information you need to make an informed decision.

Here are some key questions to ask:

- Who are your financing partners? Understanding who they work with (e.g., SNAP Financial, Rinnai financing programs) can give you insight into the types of loans and terms available.

- What are the different financing plans you offer? Ask about promotional options like “No Interest No Payment” programs, low monthly payment programs, or fixed payment plans with interest. Some programs may offer up to 100% financing with no down payment.

- What are the interest rates (APR) for these plans? Get clear figures. While some promotional periods might be interest-free, understand the rate that applies afterward.

- Are there any administrative fees or prepayment penalties? As mentioned earlier, some programs have a small admin fee, and it’s crucial to confirm there are no penalties if you decide to pay off your loan early.

- How does the application process work, and what is the approval timeline? A good contractor will walk you through the steps and give you an estimate of how quickly you can expect a credit decision. Many offer fast, simple application processes with quick approvals.

- Can the financing include other home improvement projects? Some flexible credit lines allow you to include other projects within the loan, or provide an open credit line for future purchases.

Asking these questions will help you choose the best easy finance water heater solution for your specific needs and budget. For our local customers, you can find more details on Water Heater Financing Sacramento CA.

Frequently Asked Questions about Water Heater Financing

We often hear similar questions from homeowners considering financing their water heater. Here are some of the most common ones, answered for your convenience:

Can I get water heater financing with a less-than-perfect credit score?

Yes, many programs are available for various credit levels, though terms like interest rates may vary. It’s important to discuss options with your contractor to find a plan that fits your situation. We work with partners who understand that life happens, and they strive to offer flexible solutions.

Are there any hidden fees I should be aware of?

Reputable financing plans are transparent. Always ask about administration fees, late payment fees, or prepayment penalties before signing an agreement. A trustworthy contractor will explain all costs upfront. Our commitment is to ensure you understand every aspect of your affordable water heater replacement financing, so you can make a decision with confidence.

How quickly can I get approved for financing?

The approval process is often very fast, with many providers offering instant or same-day credit decisions, allowing you to proceed with your water heater replacement without delay. We know that when your hot water is out, you don’t want to wait! Our goal is to get you approved and your new water heater installed as quickly as possible.

Get Your New Water Heater Today

A broken water heater can be a real headache, but financing doesn’t have to be. As we’ve explored, financing is a smart, flexible tool that empowers you to get the hot water you need, when you need it, without the immediate financial strain. Don’t delay your home’s comfort or compromise on efficiency. By taking advantage of easy finance water heater options, you can upgrade to a modern, energy-efficient model that saves you money on utility bills for years to come.

For homeowners in Northern California, including Sacramento and Rancho Cordova, Go Pro Plumbing provides expert installation and can guide you through your options, ensuring you find the perfect water heater and the right financing plan to fit your budget. We’re committed to outstanding customer service and same-day service, making your water heater replacement experience as smooth and stress-free as possible.

Ready to explore your options? Learn more about our hot water heater financing solutions today!