Hot Water Heater Replacement: Financing Made Simple

By Brian on October 14, 2025

Why Financing Your Water Heater Replacement Makes Financial Sense

When you need to finance water heater replacement, several options can turn an unexpected expense into manageable monthly payments. Common methods include:

- Personal loans – Fixed rates and predictable payments.

- Contractor financing – Often feature 0% APR for qualified buyers.

- Home equity loans – Lower rates secured by your home.

- Credit cards – Immediate approval but can have higher interest.

- Utility programs – Offer rebates for energy-efficient models.

Most water heaters should be replaced around the 10-year mark. At this age, your system may show warning signs that it’s becoming inefficient and unreliable. While replacement costs range from $800 to $1,600 for traditional units and over $3,000 for tankless systems, financing makes this purchase affordable. It allows you to enjoy the benefits of a new, efficient water heater immediately without a large upfront expense.

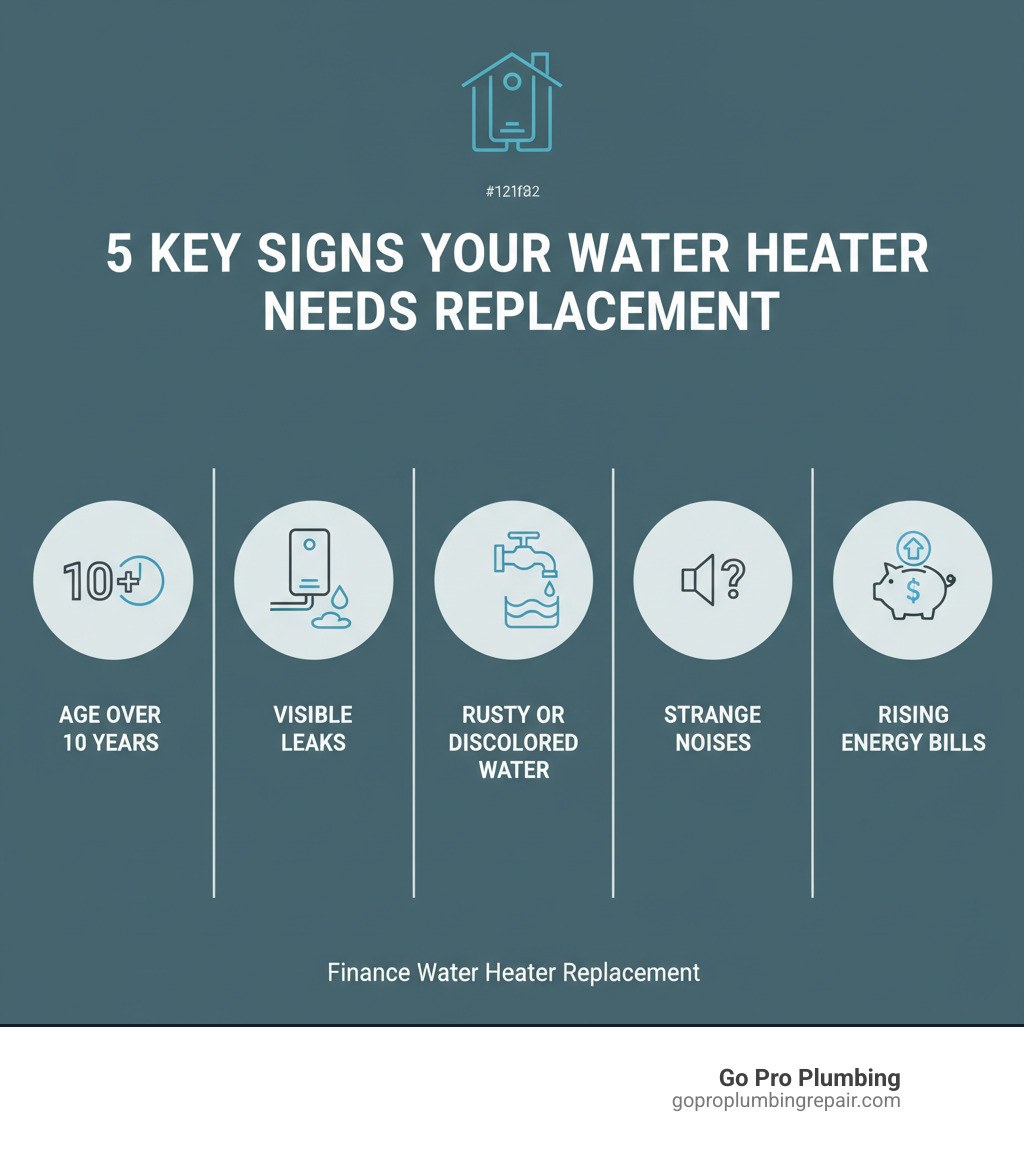

A failing water heater is an emergency. Understanding the signs it’s failing can save you from a cold shower and costly water damage. Look for these symptoms:

- Age: If your unit is over 10 years old, its efficiency is likely declining, and its warranty may have expired.

- Leaks: Puddles around the base indicate internal corrosion that could lead to a major failure.

- Rusty or Discolored Water: A reddish or brownish tint in your hot water suggests the inside of the tank is rusting.

- Strange Noises: Popping or rumbling sounds often mean sediment buildup is reducing efficiency and causing damage.

- Rising Energy Bills: An unexplained increase in utility bills can mean your aging heater is working harder and less efficiently.

Ignoring these signs can lead to bigger problems. For more details, see our guide on Common Water Heater Problems and Solutions. When these signs appear, it’s time to consider a replacement and explore your financing options.

Understanding the Full Cost of Water Heater Replacement

When your water heater fails, understanding the full cost helps you make smart decisions about how to finance water heater replacement. Homeowners typically pay between $800 and $1,600 for a traditional tank water heater replacement. A modern tankless system can cost $3,000 to $6,500 or more.

Several factors influence the final price. The unit type is the biggest variable, followed by size and capacity. More energy-efficient models cost more upfront but reduce utility bills over time. Brand reputation, advanced features, and extended warranties also add to the price but provide value and peace of mind.

Installation costs can be a surprise, with professional labor running $50 to $200 per hour. A typical installation costs $200 to $600 and includes more than just swapping units. Our plumbers in Sacramento and Rancho Cordova handle permits and code compliance, necessary modifications to electrical, gas, or venting systems, and proper disposal of your old unit. A detailed, itemized quote clarifies exactly what you’re paying for. Homeowners can learn more with our guide on Cost-Effective Solutions for Water Heater Replacement in Sacramento.

Comparing Water Heater Types and Costs

Choosing a new water heater involves balancing your family’s needs, your budget, and long-term savings goals.

| Water Heater Type | Upfront Cost | Operating Cost | Lifespan | Pros | Cons |

|---|---|---|---|---|---|

| Tank (Storage) | $650-$2,500 | Moderate | 10-12 years | Lower upfront cost, handles high demand, straightforward replacement | Less efficient, bulky, can run out of hot water |

| Tankless | $1,000-$3,500 | Low | 15-20 years | Endless hot water, space-saving, up to 30% more efficient | Higher upfront cost, may need electrical upgrades |

| Hybrid (Heat Pump) | $1,200-$3,500 | Very Low | 10-15 years | Extremely efficient, significant energy savings | Needs more space, works best in moderate climates |

| Solar | $1,500-$6,000 | Very Low | 20+ years | Eco-friendly, lowest operating costs, tax incentives | Highest upfront cost, weather-dependent |

Tank water heaters are a popular, budget-friendly choice. They store 30 to 80 gallons of hot water but are less efficient as they constantly reheat water.

Tankless water heaters are efficiency champions, heating water on demand. They are up to 30% more energy efficient than tanks and last longer, saving you money over time.

Hybrid heat pump water heaters use heat from the surrounding air, making them incredibly efficient. They are a great fit for the moderate climates found in many Northern California homes.

Solar water heaters offer the ultimate in eco-friendly operation with nearly zero operating costs. Tax credits and rebates can help offset the high initial investment. Learn more in our Environmentally Friendly Water Heaters guide.

Ownership vs. Renting: Why Financing to Own is a Smart Investment

When your water heater fails, rental options promising “no upfront costs” can seem tempting. However, like renting an apartment instead of buying a house, you build no equity. When you finance water heater replacement to own it, you’re making a smart investment.

Ownership is the clear winner for long-term savings. Owning a standard 50-gallon gas water heater can save you $1,846 over 10 years compared to renting. With a tankless model, savings can exceed $2,400. This is money that stays in your pocket.

Furthermore, ownership offers significant advantages:

- Builds Home Equity: An owned appliance contributes to your property’s overall value.

- Flexibility to Choose: You can select any model that fits your needs, including high-efficiency units that rental companies may not offer.

- Control Over Maintenance: You choose your service provider, allowing you to build a relationship with trusted professionals.

Renting, on the other hand, comes with serious drawbacks that aren’t always obvious. For more details, our guide on Rent to Own Water Heater options explores alternatives, but we consistently recommend financing for ownership.

The Hidden Costs of Rental Agreements

“No money down” rental offers can be misleading. Here’s what to watch for:

- Higher Long-Term Costs: Monthly rental fees of $28-$49 add up. Over a decade, you’ll pay far more than the unit’s value and still not own it.

- Contract Buyout & Transfer Fees: If you want to own the unit later or sell your home, you may face expensive buyout or transfer fees. This can complicate real estate transactions.

- Annual Price Increases: Many contracts include annual price hikes buried in the fine print, making the rental more expensive over time.

- Limited Model Selection: Rental companies often offer a limited choice of models, preventing you from selecting the most energy-efficient option for your home.

- No Ownership or Control: The rental company dictates all repair, upgrade, and replacement decisions for an essential system in your home.

Making an informed decision about your home’s hot water system means looking beyond immediate costs. When you analyze the long-term implications, financing to own is almost always the better financial choice.

Your Complete Guide to How to Finance Water Heater Replacement

When your water heater breaks, you shouldn’t have to drain your emergency fund. There are many ways to finance water heater replacement, regardless of your financial situation. At Go Pro Plumbing, we help homeowners in Sacramento, Rancho Cordova, and throughout Northern California steer this process.

Exploring Your Financing Options

Think of financing options like tools in a toolbox—the right one depends on your needs.

- Personal loans are a straightforward, unsecured option with fixed interest rates and predictable monthly payments, making budgeting easy.

- Retailer and contractor financing is highly convenient. Companies like Go Pro Plumbing partner with lenders to offer direct financing, often with promotional 0% APR for qualified buyers. Explore our Plumbing Financing Near Me options.

- Home equity loans or HELOCs are secured by your property, typically offering lower interest rates. They are ideal for larger projects or if you’re bundling other home improvements.

- Credit cards provide instant funds for immediate needs. A card with a 0% APR promotional period can be a great interest-free option if you pay the balance off before the period ends.

- Government and utility programs offer rebates and incentives for installing an Energy Efficient Water Heater, reducing your total cost.

To see what might be available now, check our Direct Water Heater Financing: Prequalify for Hot Water Solutions page.

How Your Credit Score Impacts Your Ability to Finance Water Heater Replacement

Your credit score tells lenders how likely you are to repay a loan.

- Good credit (700+) puts you in control. You’ll be offered lower interest rates, better terms, and higher loan amounts.

- Bad credit doesn’t eliminate your options. While you may face higher interest rates, financing is still possible. Some lenders specialize in working with credit challenges, and many customers find success with Plumbing Financing for Bad Credit options.

Getting pre-qualified gives you a clear budget without impacting your credit score and speeds up the purchase process.

Eligibility Requirements and the Application Process

Lenders have different requirements, but most will ask for:

- Proof of income (pay stubs, tax returns)

- A credit check

- Stable employment history

The application process is usually simple. Start with a detailed quote from a trusted plumber to know how much you need. Then, choose your financing option and complete the application, which can often be done online. Once approved, review the terms carefully. The entire process can take just hours or days, which is ideal for a water heater emergency.

Making the Right Choice: From Heater Selection to Finalizing Your Loan

Now you can choose your new water heater and secure the financing to make it happen. This is an opportunity to upgrade your home’s comfort while making a smart financial decision. By following a step-by-step process, you can line up a reliable system with manageable monthly payments.

How to Choose the Right Water Heater for Your Home

Selecting the right water heater is a chance to improve your home’s efficiency and comfort.

- Sizing: A unit that’s too small means cold showers; too big means wasted energy. For tank heaters, the First Hour Rating (FHR) tells you how much hot water is available during peak demand. Consider your household size and daily routines.

- Fuel Type: Your choice between natural gas, propane, or electric often depends on your home’s existing infrastructure. Gas and propane units usually have lower operating costs, while electric models can be more efficient and easier to install. Sticking with your current fuel type avoids expensive conversions.

- Energy Efficiency: This is where you can save money long-term. Look for the ENERGY STAR label, which guarantees the unit meets strict efficiency standards. The Energy Factor (EF) rating indicates how efficiently it heats water—a higher number means lower utility bills.

If you’re considering a tankless system, our Detailed Guide to Comparing Tankless Water Heater Options can help you decide if the upfront cost is worthwhile.

Steps to Research and Compare Financing Offers

Once you’ve chosen a heater, it’s time to finance water heater replacement smartly.

- Get multiple quotes: Contact several reputable companies to get comprehensive estimates that include the unit, installation, permits, and disposal. This tells you the exact amount to finance.

- Compare Annual Percentage Rates (APRs): The APR is your true cost of borrowing. Get pre-qualified offers from several lenders to compare them side-by-side.

- Read the fine print: Look for prepayment penalties and origination fees. Calculate the total cost of the loan, not just the monthly payment.

- Check lender reputation: Look for companies with positive customer reviews for transparency and service.

- Don’t rush: Taking an extra day to compare offers can save you significant money. The best financing fits your budget while getting you the water heater you want.

We can help guide you through both equipment selection and financing to ensure you get the best value for your Northern California home.

Frequently Asked Questions about Water Heater Financing

We hear these common questions from homeowners across Northern California every day. Let’s tackle them together.

Can I finance just the installation cost?

Yes. Most financing options are designed to cover the entire project, not just the unit. This includes professional labor, required permits, and proper disposal of your old water heater. This comprehensive approach means you get one clean financing package that covers everything for your Water Heater Replacement and Installation, preventing surprise costs.

Are there special financing programs for energy-efficient water heaters?

Absolutely. Many utility companies and government programs offer incentives to upgrade to energy-efficient models. If you choose an ENERGY STAR certified unit like a heat pump or one of the Solar Water Heaters, you may qualify for rebates, tax credits, or special low-interest loans. These programs can save you hundreds or even thousands of dollars and can often be combined with traditional financing, making an efficient upgrade surprisingly affordable.

How quickly can I get approved for water heater financing?

Approval times vary, but there are fast options for emergencies. For an Emergency Hot Water Heater Replacement, in-house contractor financing and online lenders often provide instant or same-day decisions. This means you could have hot water again within 24-48 hours. Traditional bank or home equity loans may take longer. Having your financial information ready (pay stubs, bank statements) will speed up any application process.

Conclusion

A broken water heater feels like an emergency, but it doesn’t have to break your budget. As we’ve shown, you can finance water heater replacement and turn this problem into a smart, manageable investment for your home.

The key takeaway is that owning your water heater beats renting every time. You can save nearly $2,000 over ten years just by choosing to own. Financing options exist for nearly every credit situation, from low-interest personal loans to specialized programs. By researching water heater types and comparing financing terms, you take control of the situation.

For our neighbors in Sacramento, Rancho Cordova, and throughout Northern California, Go Pro Plumbing is ready to be your trusted partner. We don’t just install water heaters; we help you steer the entire process, including finding a financing solution that works for you.

Don’t let a broken water heater leave you in the cold. Take the first step toward reliable hot water and financial peace of mind. Learn more about our flexible water heater financing solutions and let our team help you get back to the comfort you deserve.