Water Heater Financing: How to Fund Your Next Hot Water Upgrade

By Brian on February 21, 2026

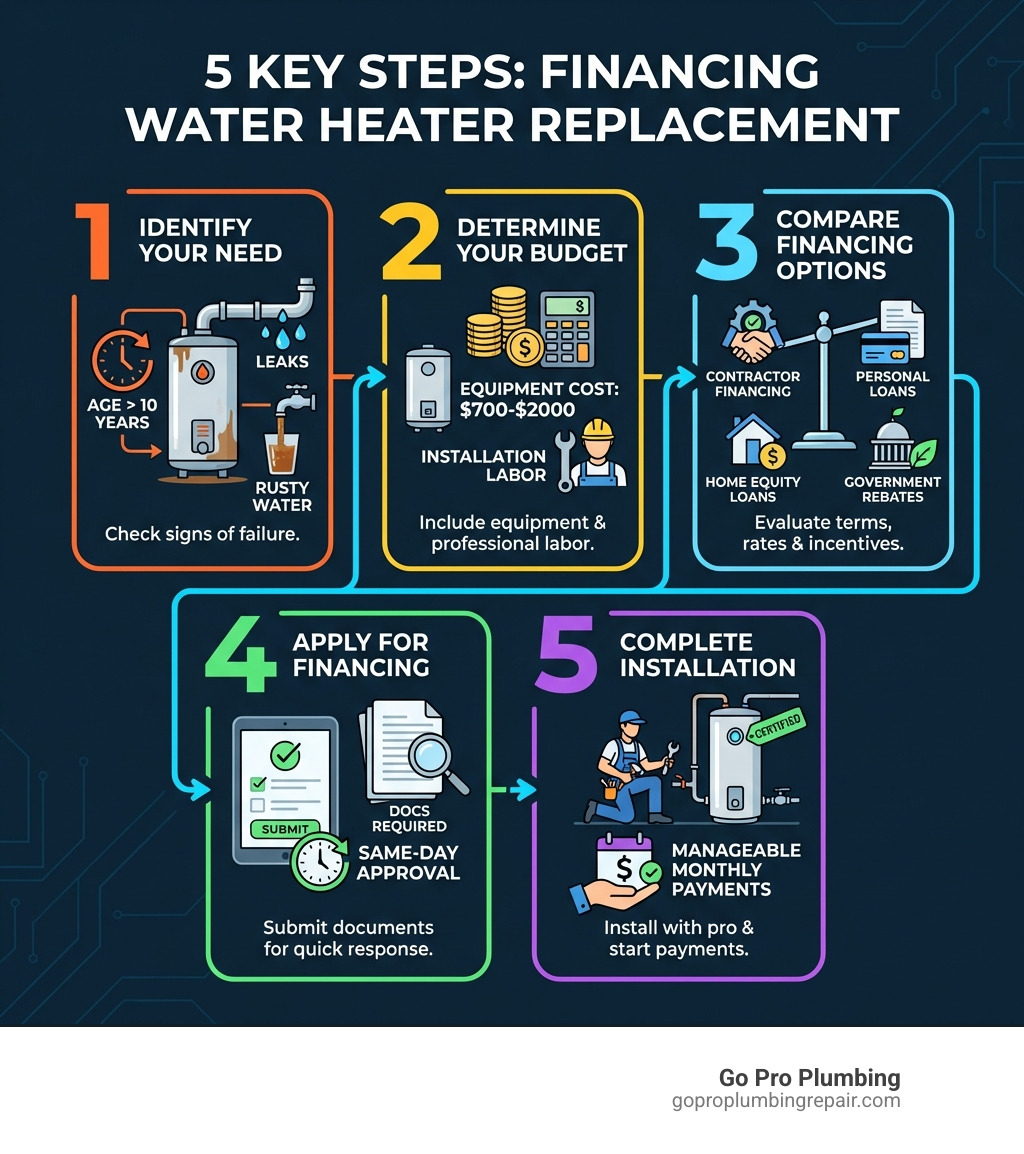

Why Financing Your Water Heater Replacement Makes Sense

Financing water heater replacement can turn an unexpected expense into a manageable monthly payment. Nobody likes taking cold showers or baths, but when your water heater fails, you might not have $800 to $2,000 sitting in savings to cover the replacement.

Quick Answer: Your Main Financing Options

- Contractor Financing – Many plumbers offer 0% financing for 12-60 months with qualifying credit

- Personal Loans – Home improvement loans with APRs as low as 6.99%

- Home Equity Loans/HELOC – Borrow against your home’s value

- Credit Cards – Use existing credit or apply for a new card

- Government Programs – Rebates and tax credits up to $2,000-$14,000 for energy-efficient models

- Bad Credit Options – Specialized lenders, co-signers, or secured loans

Most people spend between $811 and $1,566 to replace a traditional hot water heater. Tankless systems cost more upfront but last longer. The good news? You have multiple ways to spread these costs over time instead of paying everything at once.

Financing also opens the door to energy-efficient upgrades that save money long-term. Heat pump water heaters are up to three times more efficient than conventional models, and water heating typically costs households $400-$600 per year. An efficient upgrade can pay for itself while you make affordable monthly payments.

Whether you’re dealing with rusty water, strange noises, or complete failure, financing helps you act quickly. Many Northern California homeowners face the same challenge—and the same opportunity to upgrade without financial stress.

Financing water heater replacement glossary:

First, Is It Time for a Replacement? Costs and Key Signs

Before we dive deep into financing water heater replacement, let’s first figure out if you even need a new water heater. It’s like checking the oil before a long road trip – you want to know what you’re dealing with! This section will help you determine if you need a new water heater and what to budget for, setting the stage for financing.

Typical Costs for Water Heater Replacement

Let’s be honest, nobody enjoys an unexpected bill. But knowing the potential costs can help you plan and explore your financing options. The cost of a water heater replacement can vary quite a bit, depending on the type of unit, its size, and the complexity of the installation.

For a standard tank-style water heater, the typical cost for materials and labor can range from $700 to $2,000. Most homeowners in Sacramento, Rancho Cordova, and across Northern California will spend between $811 and $1,566 to replace their hot water heater. This range usually covers the removal of your old unit, the purchase of a new standard tank, and its professional installation.

If you’re considering a tankless water heater, the upfront costs can be a bit higher. While they offer long-term savings and a longer lifespan, the initial investment for a tankless system often exceeds that of a traditional tank. Factors like whether you’re switching fuel types (e.g., electric to gas), upgrading your electrical panel, or needing new venting can all drive up the price. We always provide transparent pricing and discuss all options to find the most Cost-effective Solutions for Water Heater Replacement in Sacramento for your home.

Signs Your Water Heater is Failing

So, how do you know it’s time to consider a replacement rather than just a repair? Your water heater, much like a good friend, will usually give you some warning signs before it completely gives up.

One of the biggest indicators is age. A tank-style water heater is generally accepted to last between 8 to 12 years on average. If yours is creeping past that decade mark, it’s prudent to start thinking about a replacement to avoid an emergency situation. Tankless water heaters, on the other hand, boast a much longer lifespan, often lasting 20 years or longer!

Beyond age, keep an eye (or ear) out for these red flags:

- Rusty or Discolored Water: If your hot water comes out reddish or brownish, it could indicate rust inside the tank. This isn’t just unpleasant; it means your tank’s integrity is compromised and a leak might be imminent.

- Rumbling Noises: Strange sounds like rumbling, popping, or banging coming from your water heater often signal sediment buildup at the bottom of the tank. This sediment not only reduces efficiency but can also cause damage over time.

- Leaks or Moisture: Any puddles around the base of your water heater are a clear sign of trouble. Even small leaks can quickly escalate into a major flood, causing significant damage to your home.

- Inconsistent Temperature: If you’re constantly running out of hot water faster than usual, or the temperature fluctuates wildly, your heating elements or thermostat might be failing.

Ignoring these signs can lead to more costly problems, including an Emergency Hot Water Heater Replacement when you least expect it. Addressing these issues proactively can save you stress and money in the long run. For more details on what might be ailing your unit, check out our guide on Common Water Heater Problems and Solutions.

Choosing the Right Water Heater for Your Home

Once you’ve decided a replacement is necessary, the next step is choosing the right unit for your needs. This is where the fun (and the efficiency savings!) begins.

Tank vs. Tankless Water Heaters

| Feature | Tank Water Heater (We understand this is a significant decision for your home. Our team at Go Pro Plumbing is here to help you make an informed choice for your home water heater replacement.

Your Complete Guide to Financing Water Heater Replacement

Now that we know what to look for and what to expect in terms of cost, let’s talk about the important part: how to pay for it. Financing water heater replacement doesn’t have to be a headache. In fact, many options can make upgrading your hot water system surprisingly affordable. This section covers the primary ways to pay for your new water heater over time.

Exploring the Top Financing Options

When it comes to covering the cost of a new water heater, you’ve got more choices than just pulling out your credit card. Here are some of the most common and effective ways to secure the funds:

- In-House Contractor Financing: Many local plumbing companies, including us at Go Pro Plumbing, understand that a new water heater is often an urgent and significant investment. That’s why we partner with financing providers to offer flexible payment plans. These can include attractive options like 0% interest for up to 60 months with qualifying credit. Often, you can get a decision on the same day, making this a convenient choice when you need quick action. This type of financing streamlines the process, as you’re arranging funding directly through the company handling your installation.

- Personal Loans: These are unsecured loans from banks, credit unions, or online lenders. They can be a great option for financing water heater replacement because they often come with fixed interest rates and predictable monthly payments. Platforms like Acorn Finance connect you with various lenders, allowing you to compare offers without impacting your credit score initially. We’ve seen APRs as low as 6.99% for those with good credit, and funding can sometimes be available in as little as one business day.

- Home Equity Loans (HELOC): If you own your home and have built up equity, a home equity loan or a Home Equity Line of Credit (HELOC) can be an excellent way to finance home improvements. These typically offer lower interest rates because they’re secured by your home. However, they involve a longer application process and your home is used as collateral.

- Credit Cards: For smaller replacements or if you have a card with a low-interest introductory offer, using a credit card might seem appealing. It’s quick and easy. However, be cautious: if you can’t pay off the balance before any promotional periods end, high interest rates can quickly make your water heater much more expensive.

- Leasing Programs: While less common for direct ownership, some companies or manufacturers might offer leasing programs. These allow you to pay a monthly fee for the use of the equipment, with maintenance often included. It’s important to understand the terms, including whether you’ll own the unit at the end of the lease or if it needs to be returned.

For a deeper dive into these methods, explore our comprehensive guide on Hot Water Heater Financing.

How to Approach Financing Water Heater Replacement with Bad Credit

“Can I finance a water heater with bad credit?” It’s a common and understandable concern. The good news is, yes, it’s often possible. We believe everyone deserves access to hot water!

While having a lower credit score might mean facing higher interest rates or requiring a larger down payment, there are still avenues available for financing water heater replacement:

- Specialized Lenders: Some lenders focus specifically on consumers with less-than-perfect credit. They might look at factors beyond just your credit score, such as your income and employment history.

- Co-Signers: If you have a trusted friend or family member with good credit, they might be willing to co-sign a loan for you. This significantly improves your chances of approval and can help you secure a better interest rate. Just remember, a co-signer is equally responsible for the debt.

- Secured Loans: While not always ideal, a secured loan (backed by an asset like a car or savings account) might be an option if traditional unsecured loans are out of reach.

- Retailer/Manufacturer Programs: Sometimes, manufacturers or large retailers might have financing options with more lenient credit requirements, especially for energy-efficient models.

It’s crucial to be aware that loans for bad credit will typically come with higher interest rates and fees. Always read the fine print! The goal is to get your essential hot water system replaced while working towards improving your credit score for future financial endeavors. For more insights on this topic, visit our page on Plumbing Financing for Bad Credit.

Comparing Offers to Get the Best Financing Water Heater Replacement Deal

You wouldn’t buy the first car you see, right? The same logic applies to financing water heater replacement. Shopping around and comparing offers is key to getting the best deal for your situation.

Here’s what to keep in mind:

- Get Multiple Quotes: Start by getting a few quotes for the water heater replacement itself from reputable plumbers in Sacramento or Rancho Cordova. This ensures you’re getting a fair price on the equipment and installation before you even think about financing.

- Compare APR (Annual Percentage Rate): This is the true cost of borrowing, including interest and fees. A lower APR means you’ll pay less over the life of the loan.

- Loan Terms: How long do you have to repay the loan? Shorter terms usually mean higher monthly payments but less interest paid overall. Longer terms mean lower monthly payments but more interest. Find a balance that fits your budget.

- Total Cost of Loan: Calculate the total amount you’ll pay back, including all interest and fees. Sometimes a loan with a slightly higher APR but shorter term can end up costing less overall.

- Check for Promotions and Special Discounts: Many plumbing companies, like us, run promotions or offer discounts. Always ask! You might find a limited-time 0% financing offer that can save you a significant amount. Keep an eye out for these to make your Affordable Water Heater Replacement even more budget-friendly.

The Application Process and What to Look For

Applying for financing water heater replacement is generally straightforward, especially with modern online applications.

Here’s a general overview of the process:

- Application Steps: You’ll typically fill out an application form, either online, in person with your plumber, or through a third-party lender. This will ask for personal details, income information, and sometimes employment history.

- Required Documents: Be prepared to provide proof of income (pay stubs, tax returns), identification (driver’s license), and potentially bank statements.

- Approval Timeline: This can vary wildly. Some in-house contractor financing options or online personal loan platforms can give you a decision in minutes, often with same-day approval. This is incredibly helpful when your old water heater decides to retire without notice! Other, more traditional loans (like home equity loans) can take days or even weeks.

- Key Loan Terms to Scrutinize: Before signing anything, make sure you understand:

- Interest Rate: Is it fixed or variable?

- Fees: Are there origination fees, application fees, or annual fees?

- Prepayment Penalties: Can you pay off the loan early without being charged extra? We always recommend paying more than the minimum if there are no prepayment penalties, as it saves you money on interest in the long run.

Understanding these details will help you make an informed decision. For more guidance, our Easy Water Heater Financing Guide breaks down the specifics.

Save Money with Rebates, Tax Credits, and Energy Efficiency

Beyond just financing the upfront cost, there are fantastic opportunities to save money on your new water heater through government programs and energy efficiency. Upgrading to an efficient model can open up significant savings that make financing water heater replacement even more affordable, potentially even offsetting a good portion of your investment.

Federal Tax Credits for High-Efficiency Upgrades

The federal government is keen on encouraging homeowners to adopt more energy-efficient technologies, and your water heater is no exception. Thanks to the Inflation Reduction Act (IRA), there are substantial incentives available:

- Energy Efficient Home Improvement Credit: This program offers a tax credit of up to $3,200 for qualified energy-efficient improvements to your home.

- Heat Pump Water Heaters: If you opt for a heat pump water heater, you could claim up to $2,000 as a tax credit. These units are highly efficient, using electricity to move heat rather than generate it, making them up to three times more efficient than conventional electric resistance water heaters. To qualify, the unit must be ENERGY STAR certified and meet specific efficiency tiers. Check out the details on the Heat Pump Water Heaters Tax Credit for eligibility.

- Natural Gas, Propane, or Oil Water Heaters: For those installing high-efficiency gas, propane, or oil water heaters, a tax credit of up to $600 is available. These also need to be ENERGY STAR certified and meet specific Uniform Energy Factor (UEF) requirements. You can find more information on the Water Heaters (Natural Gas) Tax Credit .

- Residential Clean Energy Credit (for Solar): If you’re going green with a solar water heater, you can reduce your tax obligation by 30% of the installation costs, with no annual maximum. This is a fantastic incentive for a truly sustainable hot water solution.

Claiming Your Credits: To claim these federal tax credits, you’ll need to file IRS Form 5695 with your tax return. It’s always a good idea to consult with a tax professional to ensure you maximize your savings and meet all eligibility criteria.

Government Assistance Programs

Beyond tax credits, there are several government programs designed to help individuals and families, particularly those with lower incomes, afford essential home upgrades like water heater replacements.

- Weatherization Assistance Program (WAP): Administered by the Department of Energy, WAP helps families living at or below 200% of the federal poverty level reduce their energy bills. After applying through your state agency, a local contractor conducts a home energy audit, and based on the Savings Investment Ratio (SIR), upgrades like water heater replacements can be prioritized.

- Low-Income Home Energy Assistance Program (LIHEAP): This program primarily assists households living at or below 150% of the federal poverty level with their utility bills. While LIHEAP mainly focuses on energy costs, by alleviating that burden, it can free up funds for necessary home repairs like a new water heater.

- Section 504 Grants: For senior citizens (age 62 and older) living in rural areas, the USDA offers Section 504 grants of up to $10,000 for home repairs to remove health and safety hazards, which can certainly include a failing water heater.

These programs can significantly reduce or even cover the cost of a new water heater, making it accessible to those who need it most. For a comprehensive look at these and other options, refer to Free Water Heaters: Six Government Assistance Programs . We encourage you to explore these options if you meet the eligibility criteria, as they can be a game-changer for your home’s comfort and safety.

How Energy Savings Offset Financing Costs

Here’s a little secret: a new, energy-efficient water heater doesn’t just provide reliable hot water; it can also put money back in your pocket every month! This is a crucial factor when considering financing water heater replacement.

Water heating is typically the second-largest energy expense in a home, adding up to approximately $400-$600 each year for the average household. That’s a significant chunk of your utility bill!

By upgrading to a more energy-efficient model, especially a heat pump water heater, you can drastically reduce these ongoing costs. Heat pump water heaters (HPWHs) are up to three times more efficient than conventional electric resistance water heaters. This means they use significantly less energy to provide the same amount of hot water.

Imagine this: your new, efficient water heater could save you $20, $30, or even more on your utility bill each month. These savings can directly offset a portion of your monthly financing payment, effectively making your new water heater pay for itself over time. When we help you choose an Energy Efficient Water Heater for your Northern California home, we’re not just installing a product; we’re installing a long-term savings solution. Calculating the Return on Investment (ROI) often shows that the initial investment, made manageable through financing, is well worth it for the long-term savings and comfort.

Frequently Asked Questions about Water Heater Financing

We know you might have more questions, so we’ve gathered some of the most common ones about financing water heater replacement here.

What is the average lifespan of a water heater?

The lifespan of your water heater depends heavily on its type and how well it’s maintained. A traditional tank-style water heater typically lasts 8 to 12 years. If your tank is 15 years old, it’s definitely time to consider a replacement soon! A tankless water heater, on the other hand, can last 20 years or more with proper maintenance. This longer lifespan is a key factor to consider when you’re looking at long-term financing, as a tankless unit might be a better long-term investment.

Where can I find reputable contractors for water heater installation?

Finding a trustworthy contractor is paramount. You can start by checking online reviews on platforms like Google and Yelp, and asking for recommendations from neighbors, friends, or family in Sacramento, Rancho Cordova, or other Northern California communities. Always verify that the contractor is licensed and insured in California. Professional plumbing companies, like Go Pro Plumbing, often have vetted, experienced technicians who specialize in Water Heater Installation Repair Service. We pride ourselves on transparent pricing, expert advice, and quality workmanship.

How long does it take to get approved for water heater financing?

The approval timeline for financing water heater replacement can vary. For in-house financing offered by plumbing contractors or through many online personal loan applications, you can often receive a decision the same day, sometimes even within minutes. This rapid approval is incredibly beneficial, especially during an emergency plumbing situation where you need hot water back quickly. More traditional loans, like home equity loans, might take longer due to the nature of the application and appraisal processes.

Conclusion

Facing a water heater replacement can feel like a sudden splash of cold water, but as we’ve explored, financing water heater replacement is a perfectly manageable and often smart solution. With multiple options available, from flexible contractor financing and personal loans to valuable government rebates and tax credits, there’s a path for every homeowner in Northern California to upgrade their hot water system without breaking the bank.

Upgrading to a more energy-efficient model not only secures your comfort but also saves you money on utility bills in the long run, often offsetting a significant portion of your monthly financing payments. It’s an investment that pays you back!

At Go Pro Plumbing, we’re committed to ensuring your home has reliable hot water. For expert advice, reliable same-day plumbing service in Sacramento, and guidance through the entire process—from selecting the right unit to installation and navigating financing options—trust our professionals. Ready to secure your hot water future? Explore our Hot Water Heater Financing options today and let us help you turn that cold shower into a warm memory.